Your cart is currently empty!

Home

DispensaryExchange.com

*Dispensary Quality Cannabis * 30-day money Back Guarantee * Fast Delivery

DispensaryExchange.com

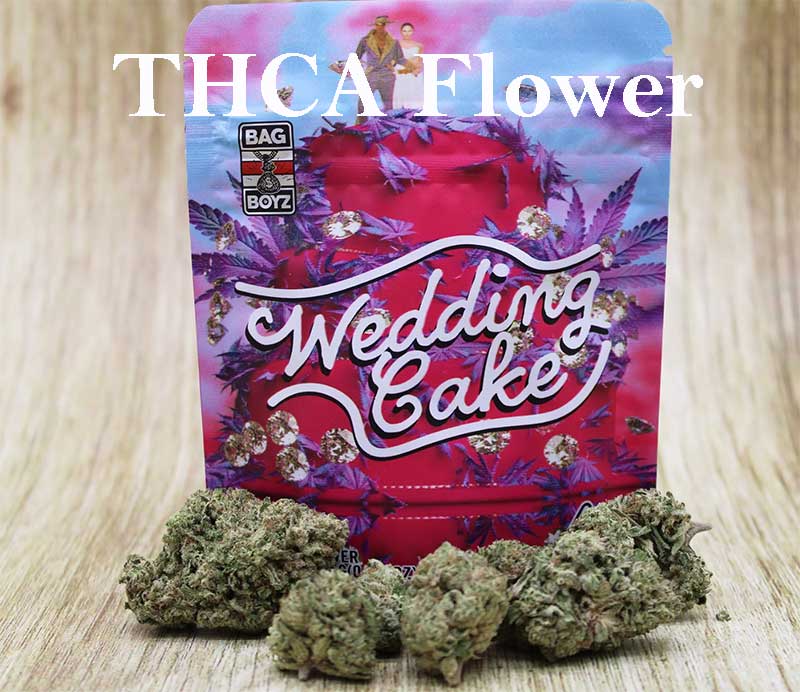

Legal Delivery of the Highest Quality THCa and Hemp Derived Products To 43 States!

We deliver the highest quality THCA greenhouse and indoor flower products to every state except for Hawaii, Idaho, Minnesota, Oregon, Rhode Island, Utah and Vermont. Our orders ship out within 48 business hours and comes with a 30 day no questions asked money back guarantee to ensure our customers are completely satisfied with our products.

Customer Reviews

Dispensaryexchange.com has some of the best fire available and plus they deliver it to my state!

We had no idea that THCa is the hottest new legal hemp derived product on the market. Our customers love it!

The new legal magic mushrooms are explosive! Finally, a place to legally enjoy our favorite past time.

If you are tired of that gas station smoke and want to taste west coast exotic strains, this is the place to get your kicks on route 66.

Buy Weed Online including, THCA Flower, Pre-Rolls, Vapes, CBD, Legal Magic Mushrooms & Concentrates Online.

Wondering why you should choose Dispensaryexchange.com for your High THCA Flower needs over another supplier? We appreciate the chance to earn your business. At Dispensaryexchange.com, no order is too big or too small. As a vertically integrated hemp-compliant cannabis farm, we specialize in cultivating top-tier greenhouse and indoor THCA flower and legal magic mushroom products.

What criteria should guide your choice of a go-to High THCA Flower supplier? Beyond flashy products, customers seek an exceptional experience. Dispensaryexchange.com distinguishes itself from other suppliers by prioritizing outstanding customer service, delivering high-quality THCA, CBD and legal mushroom products, and fostering innovation. If you want to buy weed online our team’s expertise and personalized approach make every interaction memorable. Opt for dispenaryexchange.com for reliability, excellence, and a partnership focused on your success. Treat yourself like royalty and notice the difference with us today!

Why is Dispensaryexchange.com the premier THCA Products Supplier? It’s in our name—just like a king is a leader, dispensaryexchange.com leads in supplying High THCA Flower, THCA Pre-Rolls, THCA Concentrates, THCA Vapes, Legal Magic Mushrooms and Legal THC Edibles.

Here are reasons customers prefer us over competitors:

- Quality of products and services.

- Reputation and credibility.

- Customer service and support.

- Price and value.

- Brand ethos and alignment.

- Convenience and accessibility.

- Innovation and differentiation.

For all your High THCA Flower needs, look no further than dispensaryexchange.com. Consider the outlined factors when deciding on a THCA Flower company. We prioritize excellent customer service to meet your needs, build strong relationships, and foster loyalty. Your feedback is crucial for insights and enhancing the overall customer experience. Choose dispensaryexchange.com and experience excellence.

Discovering THCA: Your Questions Answered

What is THCA?

THCA, or tetrahydrocannabinolic acid, is a naturally occurring cannabinoid found in all cannabis plants.

Is THCA Legal?

Yes, our products comply with federal regulations as they contain less than 0.3% delta-9 THC by dried weight, making them legal in all 50 states of the United States.

Authenticity Check: Is This Fake Weed?

No, THCA is not synthetic. Unlike products found in gas stations with delta 8, THCA is a natural compound present in every cannabis plant ever grown.

Drug Test Concerns: Will I Fail?

Yes, it’s important to note that THCA converts directly into THC, which can result in a failed drug test.

Debunking Synthetics: Is THCA Synthetic?

Absolutely not. THCA is the primary cannabinoid present in all cannabis, whether obtained from a dispensary or sourced from earlier experiences.

Unveiling the Difference: THCA vs. THC

THCA is the acid form of THC, the component responsible for the psychoactive effects. When THCA is combusted, it transforms into THC.

Have More Questions?

Feel free to use our live chat function to connect with our experts or you can call us directly at 252-904.7062 We’re here to address any inquiries you may have.